Voice Based Payments: The Future of Money

When you look around any major city or town in your country, you’re likely to see how often people communicate with their devices, many times using their voice. Voice technology is rapidly changing how we communicate with others through our devices. Rather than call and speak to a friend or family member, it’s far more likely to open a text, speak our thoughts into our cell phone, possibly check for misspellings, and click send.

Image from Exxon

This familiarity with voice technology has led us to be comfortable using voice options in many ways. From sending money to a person to ordering groceries through an app or interacting with our favorite store, voice is becoming the dominant method for using our devices.

And this market is projected to grow significantly through this decade. A Juniper report forecasts that voice commerce is expected to reach some $80 billion by 2023. And transactions by smart home devices are expected to hit $164 billion by 2025.

This anticipated growth of the voice payments market is being driven by hundreds of voice commerce solutions from payment service providers. This is in turn growing the market, and turning more customers on to voice payment solutions.

How do voice payments work?

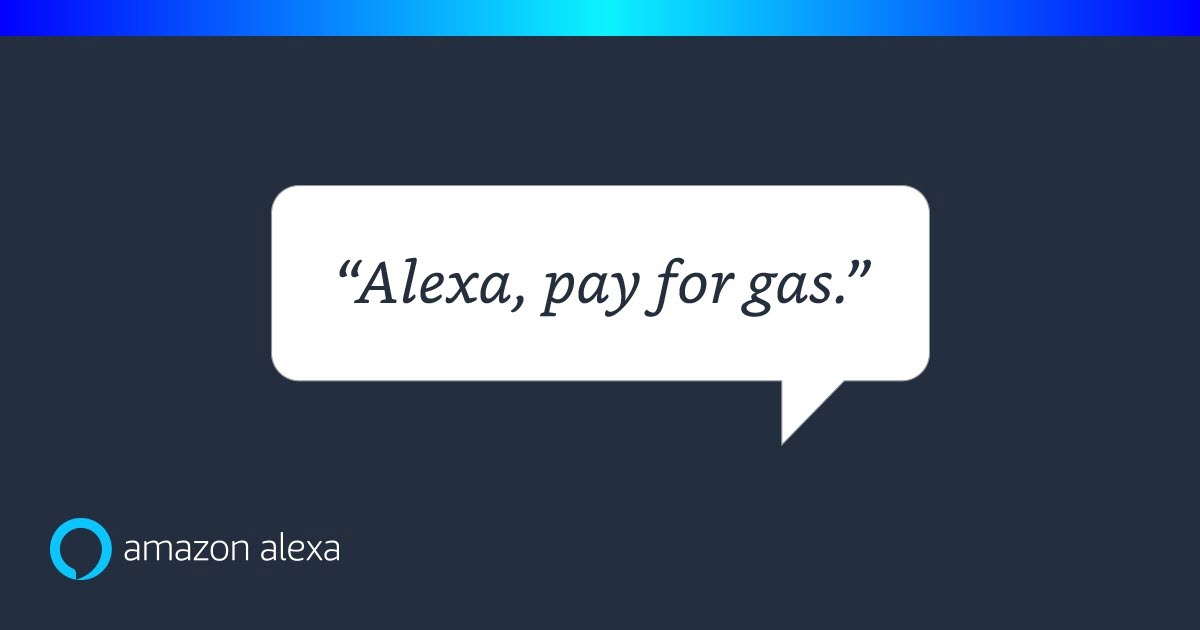

The process of setting up a voice payment account is very similar to that of paying through any online wallet. In both cases, the customer must first link their credit/debit card or their bank account details to their devices. However, in a typical wallet scenario, the customer most likely has to open the app, manually type in the details of the amount and the receiver, and then press the ok button to facilitate the payment.

However, in the case of voice payments, the customer can simply prompt his device to make the payment with a voice command, and the following steps will proceed:

- Once the choice of payment app is opened, the end-user is greeted with a screen prompting a confirmation. The customers can authorize the payment by using a password or by a simple fingerprint scan, as he wishes.

- The receiver, on the other end, will be given a confirmation message via email, text, or in-app notification of the amount he or she received.

- The process works equally smoothly in reverse. Just prompt your device to ask for a money transfer from one of your peers and the user at the other end will be sent a message to confirm the same.

Voice Payments: Use Cases

Some of the more interesting use cases of voice payments are happening in our transportation vehicles and ride-sharing world. Using Amazon Pay in combination with the Alexa mobile app, or an Alexa-enabled device in your car, like the Echo Auto, you can use voice commands and voice payments to fill up your car with gas at the pump. This Amazon and Alexa partnered service is currently available in 2022 at Exxon, Mobil, and Citgo gas stations. Unfortunately, paying via voice won’t give you any discounts on gas prices.

People also use voice payments for ride-sharing services. To ride-share using voice, enable your Uber Alexa Skill so it has access to your location. Once enabled, simply task Alexa with finding you a local Uber ride. Or you can request a premium car specifically like "Alexa, ask Uber to order an Uber Black."

Voice assistant owners can also make good use of their voice assistants for shopping needs. Reorders for consumables are especially easy to make for voice payments. Simply ask your voice assistant to reorder, for example, Black Rifle Coffee from an earlier order, and the voice assistant can make that happen.

Growth of Voice Payments

Voice-based payments are a natural outgrowth of the voice assistant revolution, led by Amazon’s Alexa, Apple’s Siri, Google Assistant, and others. Recent industry figures from Voicebot Research show that there were some 45 million adults in 2021 who had used voice assistants to shop for products at least once. That’s a big jump from 2018, when similar research showed only 20.5 million U.S. adults had used voice to shop at least once for a product. It represents a 120% increase in the number of adults comfortable enough to buy products using voice on their devices.

With more people around the globe using their mobile devices for almost every transactional purpose, it’s important for retailers to create a next-level customer experience.

That’s happening with payments. Voice technology is altering how we buy things. With voice commerce and voice payments, customers on your brand’s online store can enable the voice payment system, and choose the option to pay using voice. When this option is already pre-selected, it makes transactions that much easier.

Voice payments are already turning the traditional customer experience on its head, People are ordering full meals using voice. They scan the menu, select the items, place the order with voice, and make payment in checkout for it all. It’s becoming more the norm, and this scenario looks to grow substantially in the coming years.

The rise in the popularity of voice payments is a tribute to the ‘24*7 connected’ lifestyle. In the modern world’s fast-paced environment, voice payments are offering consumers services that save their time and are easy to use. On the other hand, brands win because they get access to the personal data and behavior trends of their customers they did not have before.

This win-win situation has made many brands and financial institutions jump on the voice payment bandwagon. Mobile payment platforms such as Zelle, Venmo, CashApp, and PayPal have become mainstream among many people to send and receive money, pay bills and make financial transactions.

Traditional banks like Wells Fargo on the other hand, are adding conversational voice interfaces to their mobile banking apps to allow their customers access to all banking services.

Some of the most well know use-cases of voice payments include:

- Peer-to-peer transfers through online wallets and platforms like Square Cash or PayPal

- Ordering products from e-commerce sites or retailers and paying via voice-enabled credit card applications.

- Using the ‘reorder’ feature to shop for order products that you buy regularly.

- Perform a variety of financial transactions including paying off card debt and fund transfers.

One example of how a brand used voice commerce to build its business is Modcup, the NJ-based coffee brand. Modcup sought to expand its customer base and get its coffee into as many mugs as possible. So the brand partnered with Blutag to create a discount deal for a new blend of coffee using a voice promotion for purchase only on Alexa.

To get there, Modcup first connected its existing Shopify store to the Blutag platform. Then, it generated a branded Alexa Skill that was live within 3 weeks on the Alexa Skill store. Third, Modcup promoted the deal to existing Modcup customers and also in a retail industry newsletter.

With Blutag's help, Modcup coffee saw a 72% conversion on the deal through Alexa, resulting in the highest number of new customers acquired in a day. Modcup continues to see a 4x increase in reorder frequency for customers that use the voice app for reordering.

Large financial enterprises like JP Morgan and Mastercard are using conversational AI platforms like KAI. Institutions like Royal Bank of Canada, Barclays, and Santander have already introduced voice-based payments via Siri, and Cognitive Banking Brain from Personetics is serving over 50 million customers across the world.

With so many use cases there is no wonder that a variety of companies have initiated processes to empower their customers with voice-based payments. However, one question still haunts this modern technology – “If voice payments are so convenient, why haven’t they still become mainstream?”

The Challenges for Voice Payments

In many ways, the challenges presented to voice payments are the same as for any new technology — Unfamiliarity, and a lack of trust. Voice payments, like any novel tech, need to justify the gap it is filling, and with money involved, it needs to become extra credible to have a wider adoption.

Here are the top challenges that voice payments are facing today:

- Security and privacy: According to a recent study, customers still find it difficult to trust the voice of systems they can’t see or feel physically. On one hand, the customers are scared of alien technology, on the other, they also fear that the same technology will become too personal.

- Accents: Voice assistants still have issues understanding different accents, especially non-American.

- Point of service integration: To ensure a wider adoption, the hardware and software component at the POS of merchants needs to be compatible with voice-activated technology. The cost of integrating with Wi-Fi and Bluetooth-enabled systems becomes a major stumbling block, however, with merchants having to cover the majority of the expenses.

- Financial institutions: As mentioned earlier, a lot of prominent names in the financial sector have started adopting voice payments. Since there has been no major overall collaboration with banks at the world scale, limited roll-outs mean that the pace of voice payments is slow for now.

Does this mean that voice payments will never truly become mainstream? That, despite all their comforts and advantages, they will continue to be an innovative tech for companies to show off? The answer thankfully is ‘No.’

The future of voice payments

Any shift in the market is usually driven by changing customer demands. For voice payments luckily, these current shifts seem to be in their favor. The increase in familiarity with technology as well as an increased desire for comfort means that millennials are easily attracted to convenience-based technology like voice payments. In a digital world, where efficiency is increased and optimized every day, voice payments can be a boon for brands and customers alike.

The adoption of Artificial Intelligence in our everyday lives is also shifting the trend toward voice applications. IoT devices such as smart refrigerators, speakers, car systems, and voice assistants are making everyday connections in daily users’ life. With such rampant usage, many industry stalwarts predict that over the next 5 years almost every technology in any industry will have voice-powered systems integrated in one way or the other.

Another issue is that people still use voice payments as a ‘trial service’, i.e. for smaller payments. The graph given below summarizes it well:

To make voice payments mainstream, the technology needs to be given more credibility. Here are some of the aspects of voice payments that need to improve in order to give it a mass appeal:

- Improved security: Voice payments are becoming more secure with each passing day. Our voices contain unique characteristics. As you speak with a voice assistant for ordering retail products, groceries, hotel reservations, and other services, the voice biometric system can immediately identify the person speaking to match it with the credit card connected to the account. There's also a personalized pin code that somebody has to say before the transaction happens. If a voice does not match the voiceprint of a credit card holder, order requests are denied. There are also backup systems in place for fingerprint checks, iris scans, and voice recognition tests to give a holistic and robust security boost to the system.

- More accuracy in accent recognition: While often struggling to recognize voice accents in the past, voice assistants are getting better at recognizing various accents. . Tech companies now testing voice systems use categories of the person’s speech to test various accents and voice congruence. For example, you may be a speaker from the American South with a slow drawl or a New Englander with a raspy squawk. The new voice accents systems are adapting and including these variations in their speech testing. AI and Machine Learning are helping understand the context behind the phrases. They can now differentiate between accents and different voice “techniques.” The gap between an AI conversation and a human voice is getting smaller by the day.

- Global deals: In a theoretical way, more seamless integration is necessary for voice assistants. You may now use Amazon Pay connected to your voice assistant, but having the ability to make voice payment work seamlessly across different platforms would be a major step forward. For example, a person could say, “use my Visa card instead of Amazon Pay”, for instance, and the voice system would verify the security of that request and offer that integration to the user. Having one complete integration deal with a Mastercard or VISA could consolidate voice-enabled solutions for most banks around the world. Similar global deals with online payment platforms or retail franchises can put voice payment adoption in a fast-track mode.

The future of voice payments is one of integration. Expect voice-enabled devices to enhance, not replace the existing technologies. A great example of this is the new Google ‘ Hands-free’. Under this voice-activated platform, the customer simply needs to walk up to the cash register with his android phone and say “I’ll pay with Google.” This will activate a system that combines Bluetooth, Wi-Fi, phone sensors, and in-store cameras to transfer payment details to the merchant. The merchant is then given the prompt to match the user in front of him with the pre-loaded image of the account holder. Assuming that the merchant is satisfied, the payment can then be authorized.

Image from Watertown Savings Bank

Smart speakers are now inside 43% of U.S. homes. This growing number of devices enables voice payments to have a new pathway into the customer’s life. Let’s have a look at this latest integration.

Voice Payments With IoT

Alexa users are already accustomed to authorizing payments via their faithful smart speakers when they purchase items from Amazon. The fact that customers are already logged in 24*7 with their smart speakers, makes the medium quite convenient for voice payments. For customers who are already comfortable with their voice-enabled speakers, venturing into voice payments is just the next logical step.

Companies have already introduced voice control technology in devices ranging from alarm clocks to washing machines. As other devices become capable of handling financial transactions, it wouldn’t be surprising if customers can eventually verbally order their refrigerator to stock up on grocery essentials or direct their washing machine to buy their favorite detergent.

Conclusion

We have already seen a revolution with mobile payments disrupting the way consumers transact. Voice commands are just the natural progression of similar technology. As voice continues to integrate with the existing ecosystem of technology expect the minor chunks to be ironed out. The promise of a comfortable, hands-free, and frictionless payment system is just too hard to ignore. Voice payments might just be the revolution that drives up the revenue and customer experience together.

According to a recent study from the global consulting firm OC&C Strategy Consultants, the value of voice-based payments is set to skyrocket, to be 164 billion by 2025.

The global voice-based payments market size is expected to reach USD 15 billion by 2030, expanding at a CAGR of 10.9% from 2022 to 2030, according to a new study conducted by Grand View Research, Inc.

This calls for a massive opportunity for retailers to build voice-enabled applications and connect them with smart speakers and other IoT equipment. There are over 100,000 skills in use today. There is a massive opportunity for retailers to build skills or connected applications for smart home speakers that will enable voice-based shopping.

Let Blutag help. We are the leading solution for adding voice commerce functionality to your ecommerce store. We provide everything for retail companies to deliver voice apps (without coding) to their customers in just a few simple steps. Reach out to us today!

Original Article Published Dec-7-2020 “Voice based payments: Future of money or money heist?